Fascination About The Dark Truth Of The Rich

Wiki Article

The Dark Truth Of The Rich for Beginners

Table of ContentsGetting The The Dark Truth Of The Rich To WorkGetting My The Dark Truth Of The Rich To WorkThe Ultimate Guide To The Dark Truth Of The RichThe Dark Truth Of The Rich Things To Know Before You Get ThisThe Only Guide for The Dark Truth Of The RichThe Main Principles Of The Dark Truth Of The Rich All About The Dark Truth Of The RichWhat Does The Dark Truth Of The Rich Do?

Take an active interest in where your money is being invested and why (The dark truth of the rich). If you can't manage to have a monetary coordinator manage your cash, find one who will review your portfolio and make suggestions for a one-time cost.With careful planning, persistence, and smart savings, you can easily make a million dollars by the time you retire. If you want to become a millionaire, the most essential thing you can do is start early so you can take advantage of compounding.

10 Easy Facts About The Dark Truth Of The Rich Explained

You get a raise at work and move to a much better apartment that costs $1,500 a month. If you want to become a millionaire, withstand the urge to give in to way of life inflation (The dark truth of the rich).

The Dark Truth Of The Rich Things To Know Before You Buy

You'll reach your monetary objectives a lot much faster. As many as 60% of working people said they feel anxious about retirement planning.The major distinction in between the 2 IRAs is when you pay taxes. With traditional IRAs, you can subtract your contributions the year you make them.

The Of The Dark Truth Of The Rich

Roth IRAs work differently. You do not get the upfront tax break. Qualified withdrawals in retirement are tax-free. Those are made when you're 59 or older and it's been at least five years since you initially contributed to a Roth. No matter what kind of IRA you have, the contribution limit is the same.The SIMPLE INDIVIDUAL RETIREMENT ACCOUNT is a tax-favored retirement strategy that particular little employers (including the self-employed) can establish for the advantage of themselves and their workers. SEP IRAs can be developed by the self-employed and those who have a couple of employees in a small company. The SEP lets you make contributions to an IRA on behalf of yourself and your employees.

The Dark Truth Of The Rich Can Be Fun For Everyone

If you begin early and save regularly, see this here you can make a million dollars by adding to your retirement savings accounts. To take complete benefit, attempt to contribute the maximum limit. Let's take an appearance at how a typical individual, let's call him Joe, can reach this million-dollar objective by the time he retires at age 67.Joe takes full benefit of the company match and postpones 5%, or $2,500, of his wage each year. Of course, in genuine life, he 'd likely get a raise and his nest egg would grow even more.

5 Easy Facts About The Dark Truth Of The Rich Explained

You can manage to sock away less cash when you're younger since you have more time to accumulate your wealth and you can tolerate more danger. If you postponed conserving till you're older, you'll have to put away more money on a monthly basis. Unless you come from a really rich household, are expecting to win the lotto, or are on the verge of getting a patent on the next fantastic creation, there's very little chance that you can prosper by doing nothing.

Fascination About The Dark Truth Of The Rich

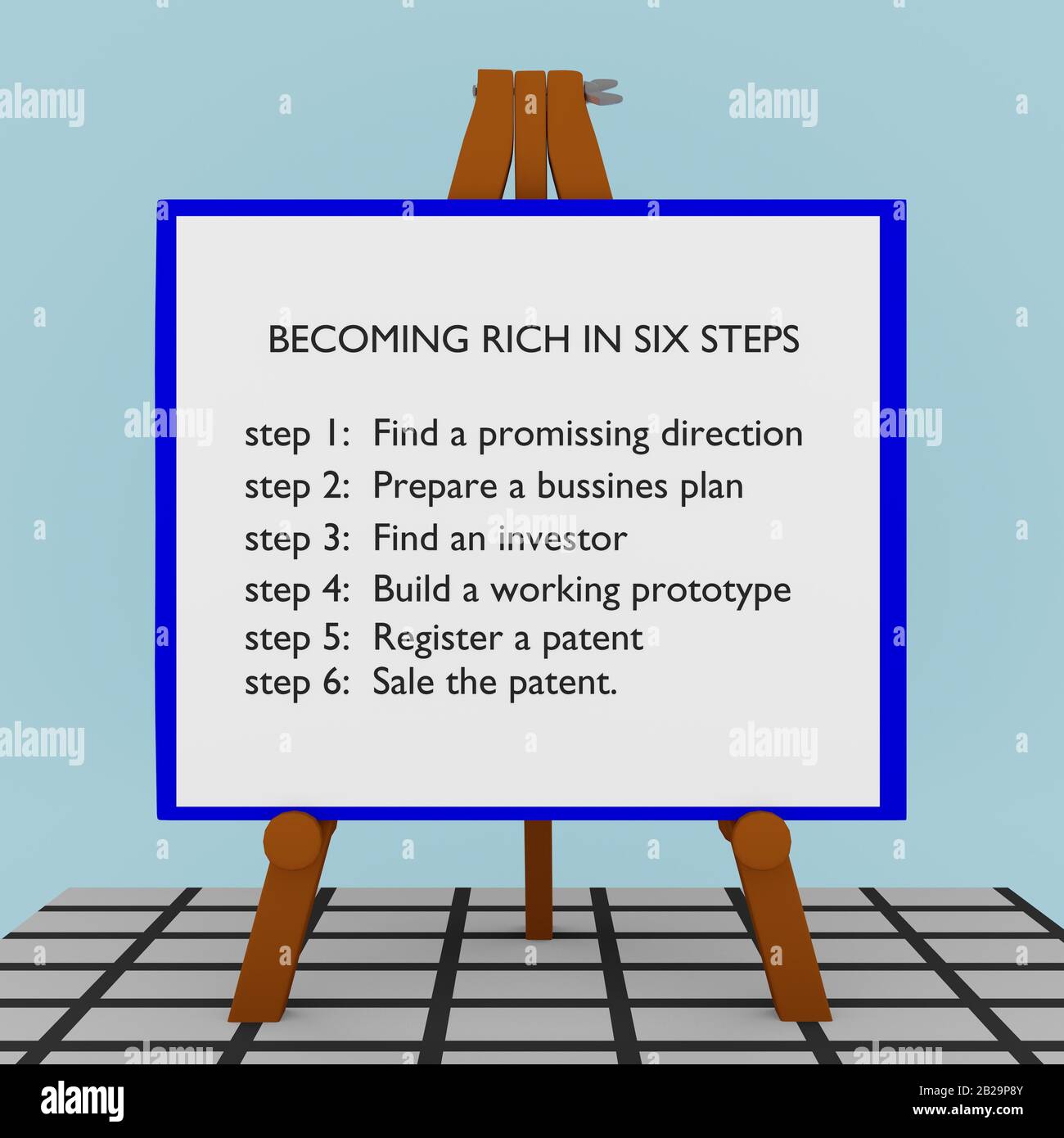

In this guide Self-made rich people don't prosper by accident. Instead, they often take deliberate actions to make money and develop wealth. If you're prepared to take control of your financial resources, choosing and devoting to a detailed plan often assists increase your wealth. Prior to you begin on ending up being abundant, create a financial strategy.

Debt with high rate of interest, such as credit card financial obligation, can be challenging to pay back. Not just are you paying the principal amount you borrowed, but you're often paying substantial interest charges. To take control of your debt, start by listing all your loans from greatest rates of interest to least expensive.

The 7-Second Trick For The Dark Truth Of The Rich

You'll likely require to specify that the extra payment is for the original loan quantity ask your lending institution if there is a certain procedure you should follow when utilizing this technique. When you have actually settled that first debt completely, move on to the loan with the 2nd highest rates of interest.

Report this wiki page